How Coffee Prices Changed Over The Years – Statistics of Coffee Costs

When I was just starting out as a barista and heard how little coffee farm workers make, I wondered how the prices for coffee can be so high, when producers get so little.

Granted, there are a lot of things going on behind the scenes. From the planting and harvesting, to roasting, packaging, brewing, and serving of these coffee beans. They all contribute to the inflation of the final cup’s price.

But still, something didn’t add up.

This prompted me to research the price trends of coffee through the years, and I must say, it gave me valuable insights into not just how the industry works, but also our role as consumers in making the prices work fairly for us and those who grow them.

I’ll share with you this knowledge and by the end of this article, you’ll gain a better understanding of coffee pricing.

Size of the Global Coffee Market

It’s no secret that coffee is one of the most sought-after commodities worldwide. After all, the drink and its caffeine kick play a significant role in our daily routines, and it shows when you look at 2020/21 data where the world consumed 166.63 million 60-kilogram bags of coffee in a year.

In fact, the size of the coffee market is estimated at $126.17 billion in 2023 and is expected to reach $158.89 billion by 2028 (Source: mordorintelligence.com).

This drink also represented about 1.6% of the total GDP in the United States in 2018, with Americans spending more than $74 billion on coffee (Source: globaledge.msu.edu).

Coffee represents about 1.6% of the total GDP in the United States.

BigCUpOfCoffee.com

But prices can be volatile, considering how it’s a seasonal crop and the seasons can differ across the coffee-producing countries making supply unpredictable (Source: unctad.org). On top of that, weather changes such as frosts and dry spells can damage the crops, leading to lower supply and increased prices.

So you may not just realize it, but the cup of joe you’re holding in your hand fuels societies, cultures, and economies around the globe.

A History of Coffee Price Fluctuations From The 1840s to The 1950s

Here’s a timeline of events that caused coffee prices to fluctuate in the US from the 1840s to the 1950s (Source: jstor.org/stable/41833268):

1840 to 1865

During the mid-19th century (1840-1850), reports of frost damage in Brazil caused slight fluctuations but didn’t make much difference overall. Ample supplies kept prices from skyrocketing during this period.

1871 to 1872

Fast forward to an unfortunate event – the Great Chicago Fire of 1871. There was more attention on the amount of coffee destroyed by the fire than Brazilian crops at that time. However, when shipments began to dwindle shortly after due to supply shortages elsewhere, prices gradually rose until reaching their peak in June 1872.

1887 to 1888

In 1887, frost significantly reduced yields causing temporary price increases towards later months of that year. Fortunately, the next year brought record-breaking harvest numbers which tamed pricing pressure down again.

1902 to 1904

Frost hit Brazil’s crops once again in 1902 followed by drought conditions in subsequent years like 1903. While these events did lower Brazilian supplies, the impact on prices wasn’t immediately significant. It wasn’t until January and February of 1904 that coffee prices took a noticeable hit.

Prices were then reduced again after the US received large offerings from other countries other than Brazil.

1918

Jumping ahead to the aftermath of World War I in 1918, reports of an estimated 40 to 80 percent crop damage sparked price increases. This rise was also influenced by hopes for reopening European markets following the signing of the armistice.

1942

Another frost incident happened in Brazil in 1942 but it didn’t affect US prices which were under price controls at the time. Brazil also had reserves, but shipping could be difficult due to the war.

1949 to Early 1950s

Then came an interesting turning point in 1949 when Brazil, the largest coffee-producing country, exhausted its reserve coffee holdings for the first time in two decades. As a result, the United States experienced rising prices as Brazil’s reduced supply affected imports. The outlook predicted continued high prices until the next crop harvest in 1955-56 and even lower ones dependent on frost-free conditions.

1954

In 1954, severe drought, disease outbreaks, and frost wreaked havoc on the Brazilian coffee crops. This unfortunate combination of events caused a substantial rise in prices once again.

As for coffee consumption through the years, it gradually increased from about 5 pounds per person every other day in 1866 to an all-time high of 19.8 pounds in 1946, impacting demand for coffee.

How Coffee Prices Changed Over Recent Decades

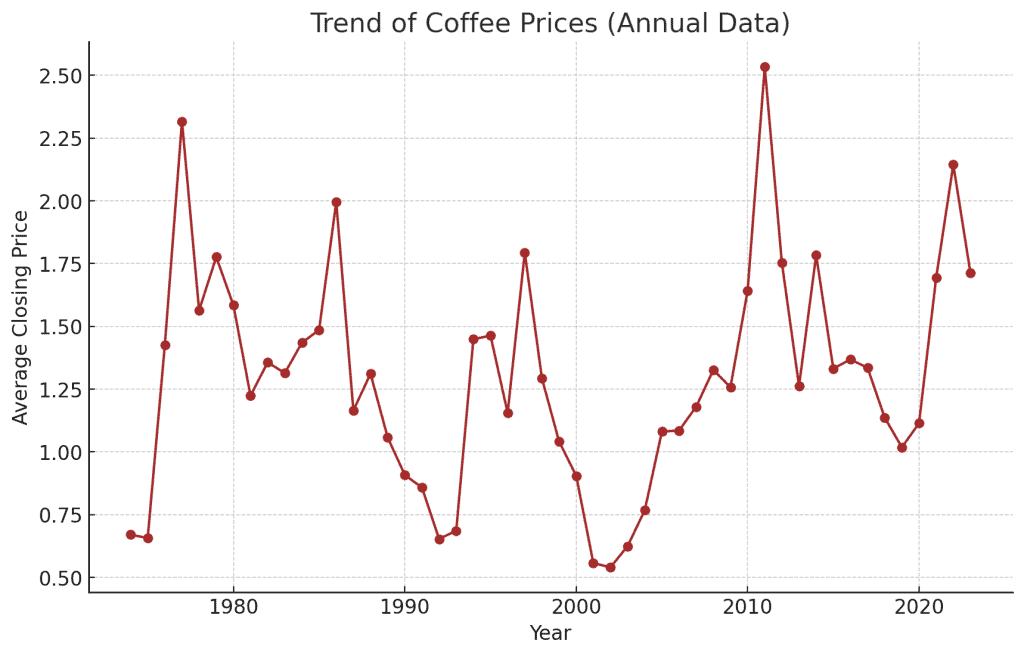

Now let’s take a look at how the prices of coffee changed more recently, from decade to decade (Source: macrotrends.net/2535/):

Mid-1970s

Coffee prices had a sharp increase in the mid-1970s, jumping from 60 cents in 1975 to reaching $1.42 the next year before peaking at $2.31 per pound in 1977.

During this time, the surge in costs was mainly attributed to the shrinking supply and the growing demand for coffee, especially after a severe frost that damaged two-thirds of Brazil’s coffee plants and a civil war erupted in Angola— the world’s 4th largest producer at the time (Source: nytimes.com/1977/01/16/archives/theres-worse-to-come-in-coffee.html).

Prices will go down to $1.56 and $1.77 respectively in the last two years of the ’70s thanks to a spurt of Robusta production in Brazil, Vietnam’s entry to the global market, and other efforts to ramp up the production of coffee (Source: oecd.org/swac/publications/39596349.pdf).

1980s

Coffee prices continued to stabilize in the early 1980s, before taking another significant increase in 1986, reaching $1.99 due to drought cutting the expected harvest in Brazil at the time, before rains eased the upward trend (Source: washingtonpost.com/archive/business/1986/01/15/big-rise-predicted-in-coffee-prices/).

In response, the international export quotas, which are the limits on how much coffee a country can export or import, were suspended (Source: documents1.worldbank.org) by the International Coffee Organization (ICO). The price of coffee then took a nosedive from almost $2 to $1.16 the next year and will continue to dip through the early ’90s.

1990s

While the export quotas for coffee were reinstated in 1987, the 1990s still began with a low price of 90 cents, going down further to around 60 cents in 1993.

The ICO’s International Coffee Agreement 1994 would then be put into effect the next year. Included in the agreement is the funding of six major projects priced at over $50 million (Source: ico.org/icohistory_e.asp). This would start driving up the prices again to $1.44, and they’ll remain stable before the prices spiral down once more, closing the decade with the coffee price of $1.04 in 1999.

2000s

Coffee prices would continue to plummet from $0.90 in 2000 to $0.54 in 2002. Considered a coffee crisis, this decrease in price was caused by the overproduction of coffee from Brazil and Vietnam (Source: researchgate.net) and traders and retailers exploiting the latter’s currency devaluation (Source: envio.org.ni/articulo/1583).

This had dire consequences such as malnutrition, unemployment, and increased migration among the communities dependent on the coffee market. As a solution, the ICO promoted crop diversification among the farmers.

Not only that, they would also aim for a sustainable coffee economy under the International Coffee Agreement in 2001. It was also around this time that the Third Wave of Coffee became known among consumers.

From an all-time low, the cost of coffee would undergo a slow recovery and would only reach a dollar in price by 2005. The decade will close with the coffee price of $1.25 in 2009.

2010s

After suffering from a long-term slump, coffee prices would peak up to an average of $2.5 in 2011. This was caused by poor harvests and the resulting lack of high-grade arabica coffee production, matched with rising demand for gourmet coffee in countries such as China, Brazil, Indonesia, and India (Source: theguardian.com).

The following year, prices were tamed back to $1.78 and would be priced at around $1.30 before going down to $1.13 and $1.01 in 2018 and 2019 respectively.

The 2020s

In 2020, the world was hit by the pandemic. Interestingly, the prices only saw a slight increase leading to $1.28 at the end of 2020. This figure points to the surplus of high-grade arabica due to the temporary closure of cafes and the like, while demand for lower-quality coffee rose as people fixed their joes at home (Source: reuters.com).

In 2021 though, while the average price overall was $1.69, the increase became more apparent when prices surged starting in October, closing the year with a $2.26 price. This is also driven by another frost in Brazil (Source: ico.org/documents/cy2021-22/cmr-1121-e.pdf).

Prices went down again in October 2022 and remained stable there, opening 2023 at $1.67, with the decrease pointing to demand-related factors (Source: stir-tea-coffee.com). Meanwhile, improvement in supply is expected to also reflect the prices of coffee in the year 2022/23.

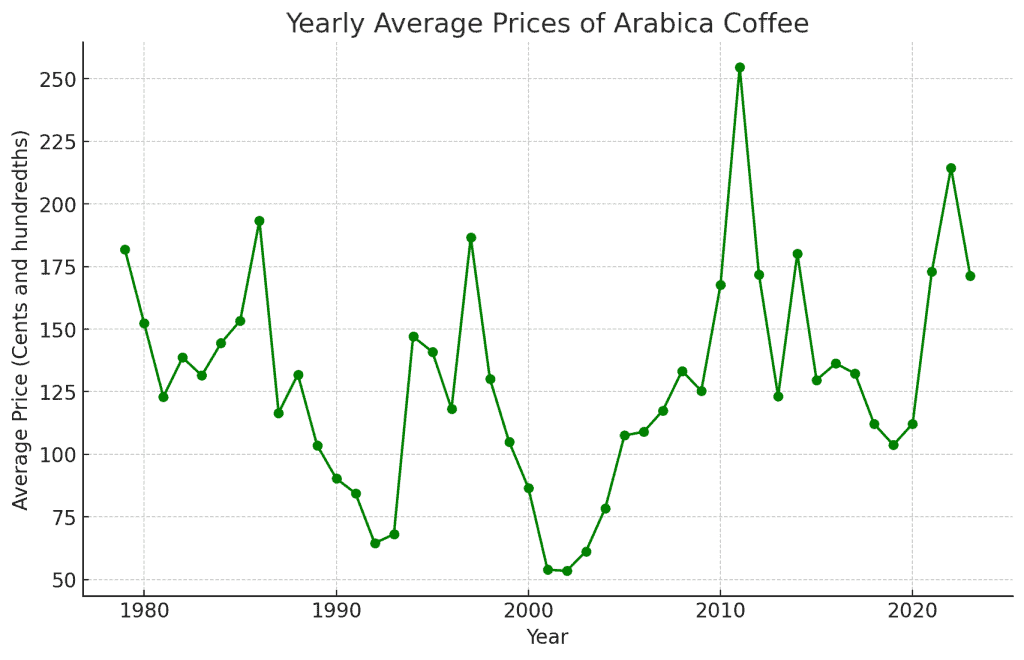

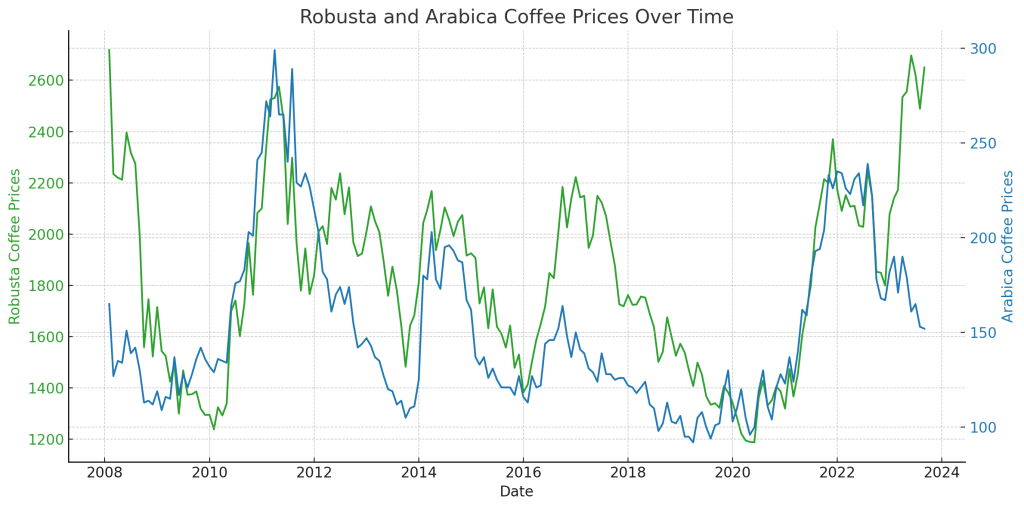

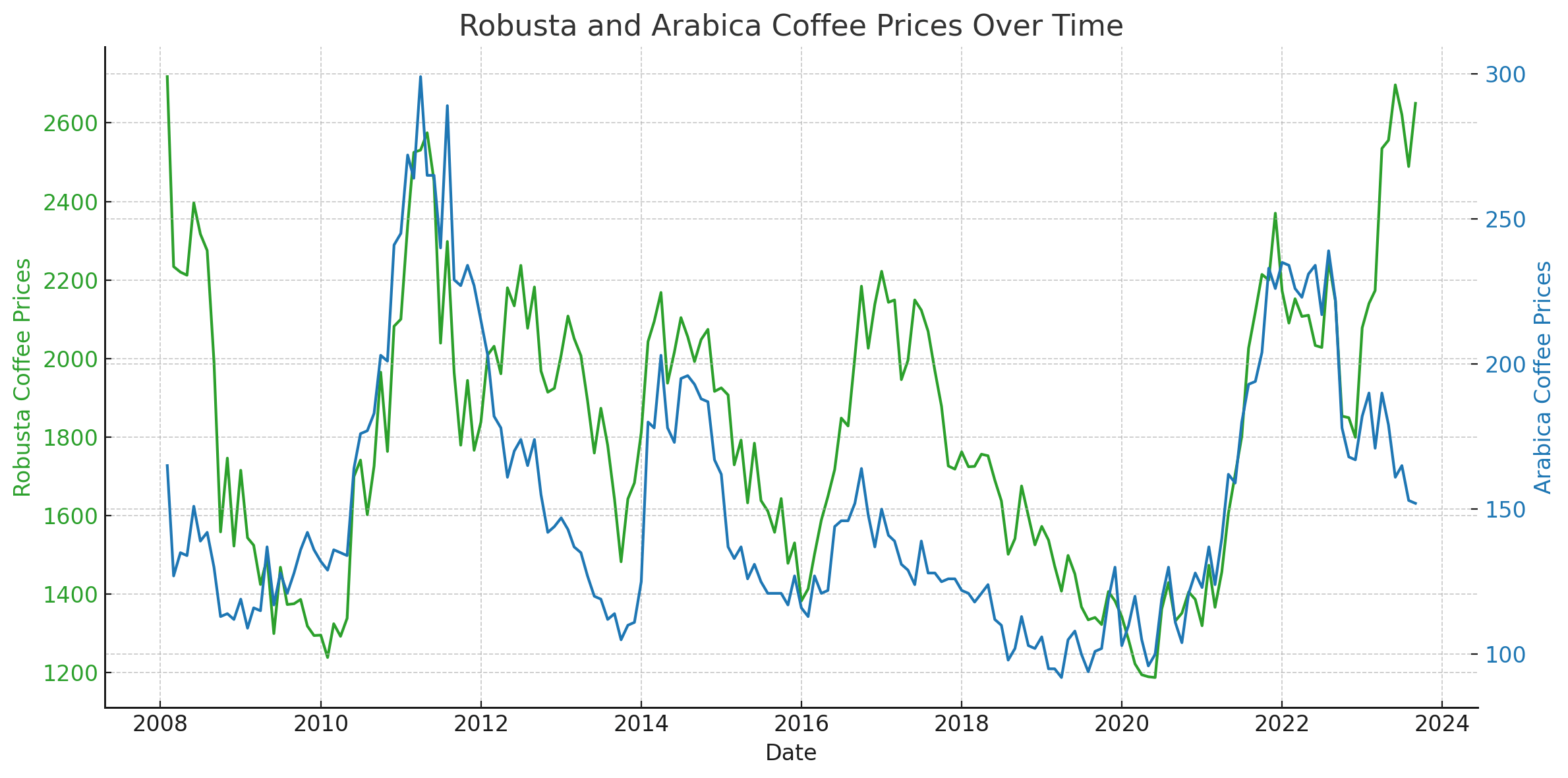

Arabica & Robusta Prices Over The Years

True coffee enthusiasts know how different Arabica and Robusta are in quality. For me, how their demands differed and affected their prices through the years is also interesting to note (Source: investing.com/commodities/us-coffee-c-historical-data).

Arabica has always been more expensive than Robusta. The main reason for this is that Robusta can grow in a wider range of altitudes and temperatures, plus it’s much cheaper to produce.

Since arabica makes up the majority of coffee exported around the globe though, the trend of arabica prices through the years mainly reflects the coffee market’s price trends discussed in the previous section.

Below is a graph of the highs and lows of Arabica prices from 1980 to 2023 as quoted on the commodity exchange:

Now I know what you’re thinking.

If the commodity price of Arabica has not moved much for decades, why is your cup of coffee so much more?

The price of a cup of joe is determined by the costs of operating in the local economy, not the commodity prices of coffee.

The price of a cup of joe is determined by the costs of running a business in the local economy, not the commodity prices of coffe.

BigCupOfCoffee.com

Meanwhile, data on Robusta coffee’s price trends are also influenced by the same events that drive Arabica’s fluctuations, but the changes are not as significant as its high-quality counterpart. However, the upward trend would not yield towards September of 2023.

You can see this on the graph below which shows the Robusta commodity prices from 2008 to 2023 compared to that of Arabica:

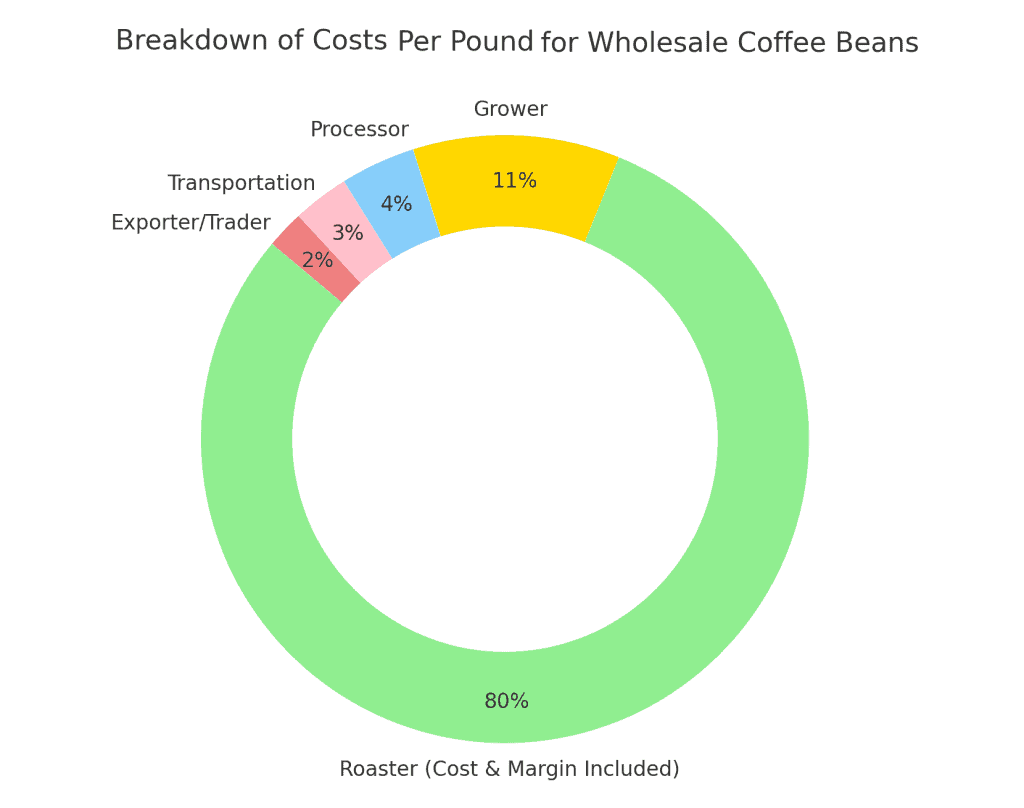

From Farm to The Shelves: Coffee Production Costs and Retail Prices

Now that you’ve got a good grasp of how green coffee prices fluctuate in the market, it’s also important that you understand how the price of a pound of unroasted coffee changes until it reaches the shelves of a grocery or the cup in a cafe.

Here’s a breakdown of the price for wholesale coffee beans:

- 80% goes to the roaster (cost & margin included)

- A little over 10% goes to the grower

- 4% goes to the processor

- 3% for transportation

- 2% for the exporter/trader

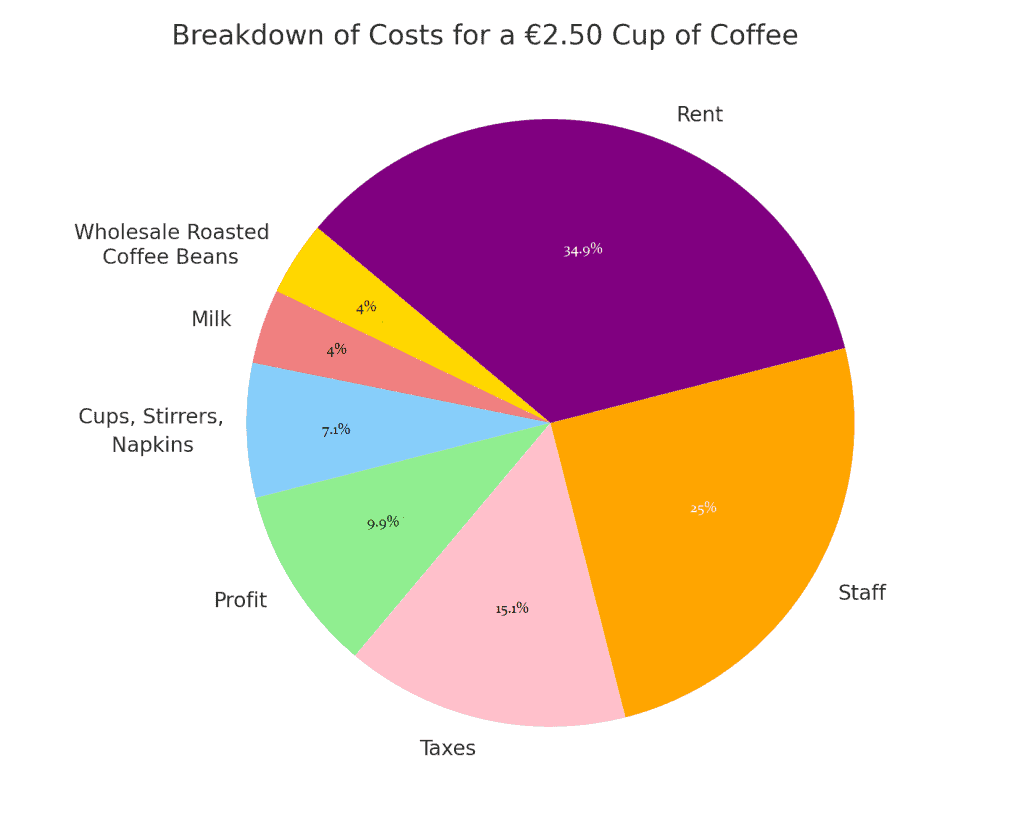

After the beans have reached the shelves, the price would more than double when you’re ordering a cup from the cafe. Here’s a breakdown of what goes into a €2.50 coffee (Source: ft.com):

- €0.10 for the wholesale roasted coffee beans

- €0.10 for the milk

- €0.18 for cups, stirrers, and napkins

- €0.25 for profit

- €0.38 on taxes

- €0.63 for the staff

- €0.88 for the rent of the shop

So as you can see, the wholesale price of coffee beans has little to do with what you actually spend on coffee at a café or supermarket.

The wholesale price of coffee beans has little to do with what you actually spend on coffee at a café or supermarket.

BigCupOfCoffee.com

The Impact of Fair Trade & Specialty Coffee

Two factors that have had a significant impact on coffee prices in recent years are fair trade and the direct trade of specialty coffee.

These movements strive to create a more sustainable and ethical coffee industry, but they also affect the cost of your morning cup.

Fairtrade-certified organizations such as Fairtrade International set a minimum price for coffee beans to give farmers better wages, plus a premium that goes to the development projects for the communities relying on coffee production. This is regardless of fluctuations in the global market.

In return, consumers know that the higher price they pay goes to the benefit of farmers and the sustainability of the coffee industry. Check out my list of fair trade coffee facts to learn more.

Similarly, specialty coffee sold through direct trade or single-origin sourcing goes to the benefit of the coffee growers. It focuses on quality-driven sourcing practices and direct relationships with farmers.

By paying premium prices for exceptional coffees, specialty roasters aim to incentivize growers to invest time and effort into producing superior crops. Of course, this also highly affects the retail price of your coffee.

At the end of the day, while these extra costs ultimately end up taken from our pockets, it’s only fair that we as consumers take part in making sure that the people behind our favorite cup of joe receive fair wages for their work.

Conclusion

Over the course of time, coffee prices have been shaken by weather shifts, global demand, and lack of supply.

Whether you work for the industry like I do, or are just passionate about your coffee, it’s important that you understand what moves these prices, and how these trends affect not only the consumers but everyone involved in bringing the beans to your cup.

So I encourage you to dive deeper into your coffee beyond quality and flavor, starting perhaps with this article on coffee statistics in 2024. Explore it as an industry and culture that can empower communities across the globe, and you’ll never look at your cup of coffee the same way. Not sure if that’s good or bad though.

The article really shed light on how complex coffee pricing can be, and I’m grateful for the insights. As someone who’s only seen coffee prices from the consumer’s end, I never fully appreciated all the different factors at play. The section on how weather affects crops and pricing finally made it click for me why my morning latte’s cost can fluctuate so much. Thanks for the deep dive.

You’re welcome, it was interesting seeing the data for me as well.

You mention how the industry has changed in recent decades, but I’m wondering if there are projections on how climate change might further affect the markets for these beans? It’s clear that our environment has played a role in historical pricing – are we looking at an upward trend in terms of costs?

I couldn’t help but reminisce about my grandfather’s coffee shop after reading this. He used to tell stories of how the price of beans would change, and your article brought those memories to life. It’s fascinating to see the historical context behind the pricing trends he experienced. This was a beautiful walk down memory lane interwoven with solid facts.